According to the ADA’s Health Policy Institute Report, 65% of Americans have dental insurance or dental benefits. That means maximizing timely reimbursement from insurance carriers is essential to healthy revenue cycle management, cash flow, and practice profitability. The caliber of your dental billing processes, the cleanliness of your claim submissions, and your diligence with appeals will determine how successfully you accomplish that goal.

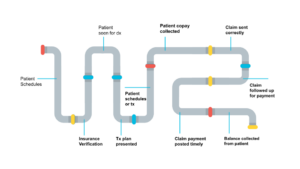

The revenue cycle pipeline starts the moment a patient schedules an appointment and ends when the patient balance is collected. The entire pipeline includes every step in-between the start and finish. Within the pipeline, opportunities exist for cracks, leaks, and stoppages to occur. You can prevent these from happening by following these five proven strategies that help streamline an office’s dental billing processes. By doing so, you will be well on your way to collecting all that is rightfully owed to your practice in the shortest time possible.

-

Develop a pre-appointment readiness plan

You might think the preparation and submission of claims is all done at the back end. But claims cannot be clean unless thorough and complete information is gathered on the front end – even before you see the patient.

Put a pre-appointment readiness plan in place. This helps ensure that accurate patient and subscriber information is collected, insurance coverage is verified, and everything is entered into the PMS before the patient arrives for their appointment. Without this process in place, time and resources are wasted chasing down, verifying, and correcting information later on. These distractions delay claim submissions.

By implementing a pre-appointment readiness plan, you can prevent the following common mistakes that often result in delays and denials:

- Listing the patient’s commonly used name instead of legal name (e.g., Bill instead of William, or middle name if typically used)

- Listing the wrong location if the insurer has multiple locations

- Finding out after the fact the patient has medical but not dental coverage

Analyze the most common causes of denials occurring at your practice. Then, continuously improve your readiness plan so as to address as many as possible on the front end. This will improve your claim reimbursement success rate.

Pre-appointment Readiness Plan Checklist

- Schedule patient with the correct provider

- Obtain patient insurance information prior to appointment

- Verify insurance coverage 2-3 days before appointment (or let eAssist’s Insurance Verification services take care of that!)

- Insurance verification breakdown completed & entered into PMS

-

Attach the correct CDT code to the service provided

Having collected complete and accurate patient and insurance information beforehand, now it’s time to serve your patient. Once again, accurate information is crucial to preventing leaks and stoppages in your revenue cycle pipeline.

The golden rule of dentistry is to always code for what you do. But that can be easier said than done. As covered in the prior section, code changes, additions, and deletions are made every year (and sometimes mid-year) – and have totaled 160 in the past three years!

Without the most up-to-date coding resources, you cannot know if your submissions are accurate, which results in delays, denials, and lost revenue from reduced or incorrect reimbursement. This also puts the practice at risk for insurance audits.

“Correct coding often results in higher revenue, as practices obtain reimbursements that were once unpaid because of misunderstanding or misreported codes.” — Dr. Charles Blair

PRO TIP: Investing in current, complete, and accurate coding reference materials each year will improve claim reimbursement, treatment planning, and more. Train the whole team and be up to date.

-

Obtain all necessary clinical documentation

Proper CDT codes, the right providers, and accurate patient and insurance information are not all that are required for clean claims. For a claim to be clean, it must have thorough and complete clinical notes and documentation captured at time of service.

Clinical note templates help keep claims squeaky clean. The ADA recommends using the SOAP format to help ensure clinical notes contain complete details regarding the patient’s dental needs, diagnoses, and treatment.

Sidebar:

| S | SUBJECTIVE – What the patient presented with

Based on or influenced by personal feelings, tastes, or opinions |

| O | OBJECTIVE – What the doctor observed

Something that is without bias; factual observations |

| A | ASSESSMENT – What the doctor diagnosed

The evaluation or estimation of the nature, quality or ability of someone or something |

| P | PLAN – Treatment plan and next appointment

A detailed proposal for doing or achieving something |

A clean claim has all the necessary documentation attached to thoroughly support the treatment provided. Simply put, the treatment is more likely to be deemed necessary in the eyes of the insurance carrier when both the what and the why behind it are clearly defined.

That said, submissions must be concise and well-organized. Your objective is to provide everything the insurance company needs and wants, but without going overboard. Providing lengthy explanations that get confusing, putting too many characters into the “narrative” box (which just get truncated), or attaching too much information can work against you. Your team will spend extra time preparing excessive submissions, only to have them kicked back because they were unclear and confusing. They will then need to spend even more time condensing and resubmitting a clearer claim, all the while negatively impacting your collections.

| Examples of critical supportive clinical documentation that effectively hits the mark: | |

|

|

However, even the best clinical notes won’t result in a quickly paid claim reimbursement if the notes aren’t signed by both the rendering provider AND the hygienist or dental assistant. A best practice is to digitally chart everything, and most Practice Management Systems allow for digital signatures.

-

Send clean primary and secondary claims

Behind inaccurate codes, the second most common cause of claim rejections and denials is incorrect information – which is entirely avoidable. Once satisfied that every detail has been reviewed for accuracy, and the claim package is clean and complete, you’re ready to submit to the insurance carrier.

Claims may be sent via mail or fax, but a best practice is to submit electronically when available. Among other benefits, this lets you bill the patient for balances due in a more timely manner, so you are also optimizing patient revenue.

Another best practice is to send claims daily. However, don’t assume the end of the day is the best time. Many practices find that submitting claims the next business morning allows for better focus and concentration to get all the details just right. Determine what works best for your office and your team.

PRO TIP: Sending clean claims daily ensures timely claim reimbursement. This helps keep patients feeling secure in your practice’s abilities – and boosts retention.

In the case of a secondary claim, attach a copy of the primary EOB that shows the amount paid by the primary payer. Use the “remarks” box to list primary carrier and paid amount so benefits can be properly coordinated. As part of your pre-appointment readiness plan, be sure you are collecting date of birth for both patient and subscriber. For example, you will need this information when a child patient is under the parent’s policy, or when dealing with dual insurances. Most carriers follow the DOB rule when determining which policy is primary and which is secondary, so collecting that information lets YOU know which is the primary claim.

-

Support the appeal process (when applicable)

According to industry leader and dental coding expert, Dr. Charles Blair, only about one-third of denied claims are appealed. Staff capacity may be the barrier, and/or team members lack the knowledge about why, when, and how to file an appeal.

Does YOUR dental biller know when to appeal or not appeal?

- Rejected claims must be reviewed for accuracy, corrected, and resubmitted. Rejected claims are the most frustrating – and most avoidable – roadblock to timely reimbursement. Always appeal!

- Disallowed claims for disallowed procedures (per the EOB) are not billable to the patient and should be written off. As disappointing as these are for the providers and the practice, they are especially frustrating for the patient when the result is an unexpected balance due. However, depending on the reason given, some should be appealed.

- Denied claims are kicked back for a reason, which will be stated on the EOB. If due to missing data or filing errors, definitely appeal. Ultimately, depending on the reason given, many should be appealed.

Analyze all your claims that are being kicked back and identify patterns in the reasons given on the EOBs. E.g., consistently missing the same information, certain CDT codes frequently misused, lack of sufficient documentation, or missing signatures. Correct your processes to fix these leaks in your revenue cycle pipeline.

In conclusion, you can increase claim reimbursements – and ultimately profits – through the following steps. 1) develop a pre-appointment readiness plan, 2) attach the correct CDT code to the service provided, 3) obtain all necessary clinical documentation, 4) send clean primary and secondary claims, and 5) support the appeal system.

Dental insurance billing is a time-consuming process that requires experience to get right. If you’re struggling with getting claims paid, consider outsourcing through a trusted dental billing platform. Click here to schedule a complimentary consultation.

0 Comments