Free Help For All Dentists

SBA Loans &

CARES Act Information

for Dentists

The

nation’s leader

in dental billing

Need help? Contact your eAssist Team or call 1-844-eAssist

22 Steps a Dentists Can Take to Get Financial Relief Right Now

-

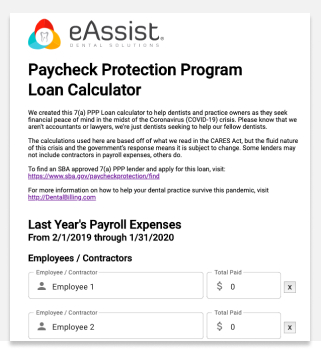

Apply for a Small Business Administration Loan. There are three options available from the CARES Act: SBA Economic Injury Disaster Loan (EIDL), the SBA 7(a) Express Loan, or the SBA 7(a) Paycheck Protection Program (PPP) Loan. If you aren’t sure which is best for your situation right now, It doesn’t hurt to apply for all three—but you can only choose one to receive money from.

-

Check the eAssist Dental Financial Relief Map for more information relief loans in your state. There may be additional disaster recovery funds available from your local and state governments. Go to map

-

Stop paying on current SBA Loans for the next 6 months. The SBA will pay them for you.

-

Stop all tax payments to the IRS. Even 2020 quarterly tax estimates. Note that the 2019 tax filing deadline has been extended to at least July 15th.More info

-

Contact the bank that holds your practice loan. Ask them to stop payments and to reduce your interest rate. If they aren’t willing to reduce your rate, refinance your practice loan with an institution that will.

-

Call your landlord and request rent abatement.

-

Pull up to $100k from your 401k or other retirement vehicles without a penalty if needed.

-

Stop payments on your federal student loans.More info

-

Call your business insurance provider to discuss if your policy will cover this disruption. Even if it doesn’t, we recommend filing a claim in the chance that laws change to force insurance companies to remove this clause.

-

Stop non-essential autopayments withdrawing from your bank account. It's important that you pay your bills, but you want to be in control of your cash flow. Pay by check during this critical time in order to do so.

-

Lock your credit cards (if available) or call your credit card companies and ask for new credit cards with new numbers to be sent to you in order for you to control what is being charged automatically to your cards. This will help you control what expenses you are authorizing.

-

Take advantage of other potential tax savings under the CARES Act. Some examples include the ability to carryback 100% of losses as far as 2013 to offset taxable income, increase in the amount of deductible interest expense, etc.

-

Refinance your mortgage, practice loan, building loan, commercial loan, and all other applicable loans. Take advantage of the interest rates while they are low and refinance while you can.

-

Under the CARES Act, you may be eligible to receive a credit against employment taxes through the end of the year equal to 50% of qualified wages.

-

Request forbearance if you have a federally-backed mortgage. You can get 180 days forebearance, extendable for another 180 days.

-

Defer payment of the employer share of social security tax through the end of the year (to be repaid over the next two years).

-

Contact your utility providers, supply company, lab, and other vendors. Ask vendors for net-90 payment terms without interest (no payment needed for 90 days interest free), discounts, and put auto-orders on hold effective immediately.

-

Guide your team to file for unemployment, even if they are working reduced hours. Your team may still qualify for unemployment-- if they’ve been furloughed or if their hours have been reduced. We do not recommend you lay off any team members at this time. Your people need your support now more than ever. It’s the right thing to do.

-

Check the eAssist Dental Financial Relief Map for more information unemployment coverage options available in your state. Go to map

-

Keep your cash flow up by following up on all aging and previous claims. Insurance companies are still open and paying claims. If you or your team aren’t able to do this in-house at this time, you can outsource this to eAssist. We can keep your collections and cash flow up, even if you’re facing closures—we only get paid if you get paid. Contact eAssist

-

Set up EFT payments from insurance companies and utilize portal submissions for claims to make sure you’re getting money in your bank account faster.

-

Sign the ADA petition for a federal disaster relief for dental practices Sign the petition

Helpful Resources for Dentists Impacted by the Coronavirus (COVID-19) Pandemic

What you can do now

Apply for all loans available in your state, check the eAssist Dental Financial Relief Map for more information on relief options in your state. If you're not sure where to start in your application for the SBA Disaster Loan, our team can help. Contact your eAssist team, or call 1-844-eAssist. We are here for you.

What we’re doing for your dental practice

We’re still fighting for every dollar rightfully owed to you.

We’re still submitting existing claims and appealing denials whether your office is open or closed.

We’re still delivering our promise of peace of mind and collect 100% of what is owed to you.

Helping us to help you

If you decide to close your office, please keep your eAssist computers and connected devices on so we can keep your collections and billing running smoothly.

What to do if your dental practice is closing due to Coronavirus (COVID-19)

Many dentists are closing their doors to help stop the spread of Coronavirus (COVID-19). If you’re one of those dentists facing temporary closings, here’s a list of things you should do before you lock your doors.

learn moreTeledentistry: What you need to know in the wake of Coronavirus (COVID-19)

With the spread of Coronavirus (COVID-19) temporarily closing offices around the country, there are more questions and demands for Teledentistry than ever. But what will insurance companies reimburse for these services?

learn moreHow to protect your practice and patients during the COVID-19 pandemic

The ADA, the White House, and many local and state-level governments have recommended, suggested, or enforced the shutdown of dental practices for non-essential and/or non-emergent cases.

learn more